Find the very best Insurance Policy Representative Near You for Personalized Coverage

When it comes to securing insurance policy coverage, locating the ideal agent to navigate the complexities of your one-of-a-kind requirements is critical. With the myriad of alternatives offered, exactly how does one go regarding selecting the finest agent near them?

Significance of Personalized Insurance Protection

:max_bytes(150000):strip_icc()/88147259-569ff3dc5f9b58eba4ae1d57.jpg)

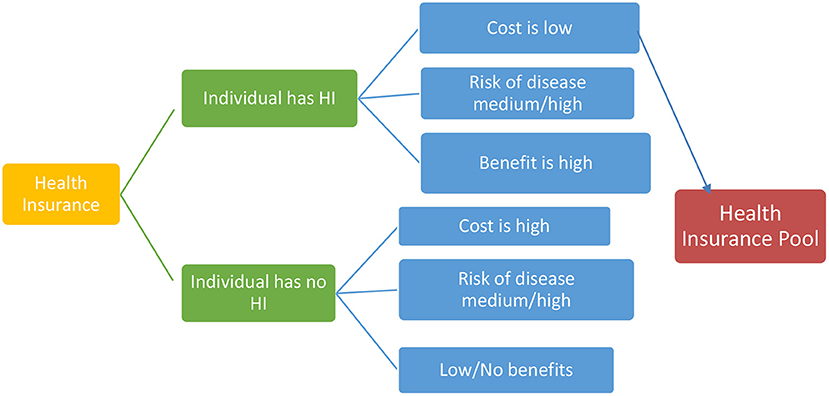

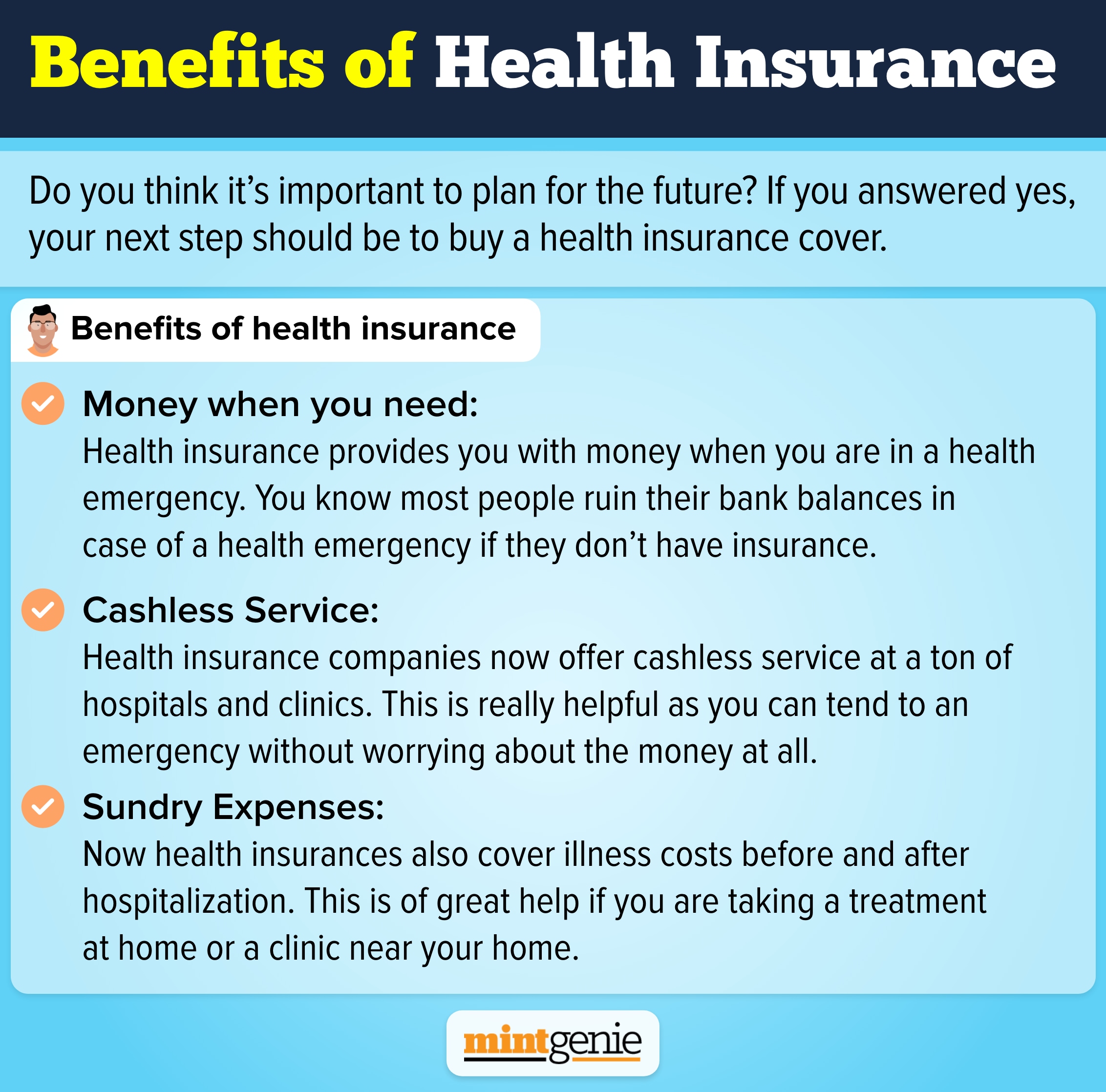

Custom-made insurance policy coverage plays an important duty in providing people with customized security against details risks and making sure adequate economic security. Unlike generic insurance strategies, personalized insurance coverage takes right into account an individual's one-of-a-kind scenarios, such as way of life, line of work, and possessions, to create a plan that addresses their details demands. This tailored approach not just provides assurance however also reduces the chances of being underinsured or paying too much for unnecessary insurance coverage.

Among the crucial benefits of tailored insurance policy protection is the capability to fill up spaces in security that conventional insurance policy plans might overlook. By working very closely with an insurance policy agent to examine threats and identify proper protection limits, people can better secure themselves against potential monetary difficulties arising from unexpected occasions. Whether it's securing a useful collection, guaranteeing appropriate responsibility coverage, or securing specialized coverage for an one-of-a-kind leisure activity or service, tailored insurance coverage plans supply a level of security that generic policies merely can not match.

Factors to Consider When Choosing a Representative

Choosing the ideal insurance policy agent is a vital choice that requires mindful factor to consider of a number of crucial aspects. One of the main factors to consider when selecting an insurance representative is their degree of experience and know-how in the sector. A representative with a solid background and a proven track document is much more likely to supply you with the customized insurance coverage you need. In addition, it is crucial to analyze the representative's track record and client evaluations to ensure they have a history of delivering superb solution and support to their clients.

Researching Resident Insurance Policy Representatives

Performing complete research on regional insurance coverage agents is vital for individuals looking for customized insurance coverage that lines up with their details needs and choices. When looking into local insurance coverage agents, beginning by seeking referrals from buddies, household, or coworkers that have had positive experiences with representatives in your area. Online evaluations and scores can likewise offer useful understandings right into the reputation and service high quality of various representatives. In her response addition, check with professional organizations or licensing bodies to ensure that the agents you are thinking about are appropriately approved and in excellent standing.

It is vital to think about the agent's experience in the certain sort of insurance you call for. Some agents specialize in automobile insurance coverage, while others might concentrate on home or life insurance. By comprehending an agent's specialization, you can guarantee that they have the expertise and experience to give you with the ideal possible insurance coverage choices. Scheduling appointments with possible agents can aid you evaluate their interaction design, level of client solution, and total compatibility with your insurance policy needs.

Questions to Ask During Agent Interviews

When taking part in meetings with insurance representatives, it is very important to ask concerning their experience and know-how in handling the particular insurance products you are interested in. Begin by asking concerning the sorts of insurance coverage they specialize in and how much time they have been collaborating with those items. Understanding their knowledge with the coverage you require can give you confidence in their ability to meet your needs.

Moreover, ask concerning their procedure for analyzing specific requirements. An excellent insurance policy agent ought to perform a thorough analysis of your circumstance to advise the most ideal insurance coverage alternatives tailored to your scenarios. Medicare agent in huntington. Ask regarding their approach to determining coverage restrictions, deductibles, and any type of extra riders that might profit you

Furthermore, it is important to talk about how the representative takes care read the full info here of cases. Comprehending their role in the cases process and how they support for their customers can supply insight right into the level of assistance you can expect in case of an insurance claim. By asking these relevant concerns during representative interviews, you can make a well-informed choice when picking the ideal insurance coverage agent for tailored protection.

Evaluating Agent Qualifications and Reviews

To make a notified choice when choosing an insurance policy agent for tailored insurance coverage, it is important to thoroughly examine their credentials Web Site and evaluations. Beginning by checking the agent's credentials, guaranteeing they are licensed in your state and have the needed qualifications to supply the insurance policy products you call for. Search for qualifications or memberships in expert insurance policy organizations, as these can indicate a higher level of expertise and commitment to market requirements.

Furthermore, think about reviewing on the internet systems and web sites for client reviews and evaluations. These can supply valuable insights into the agent's communication abilities, responsiveness, and general consumer complete satisfaction. Pay attention to any type of repeating favorable or negative remarks to obtain a sense of the representative's toughness and possible areas for improvement. Moreover, you can seek advice from friends, family members, or coworkers who have actually collaborated with the representative to collect firsthand experiences and recommendations.

Verdict